SKIMS

-

During a 3-month externship with Beats by Dr. Dre, I gained hands-on experience in both qualitative and quantitative market research for the global brand SKIMS. Leveraging survey data and consumer insights, I led the development of a comprehensive rebrand aimed at engaging a more diverse and inclusive consumer base.

My research revealed that while Gen Z consumers reported moderate levels of physical activity, their shapewear purchasing rates remained low. Additionally, I identified two distinct consumer segments: identity-driven users and wellness-oriented consumers with active lifestyles. This insight informed a strategic campaign concept that bridged both groups, emphasizing functionality and authentic brand storytelling.

-

Build out & distribute consumer surveys across target demographics

Leverage data insights into a clear and concise report fit for SKIMS CEO Emma Grede

Beyond the numbers: Connect data points to build a compelling narrative

Create an eye-catching slidedeck using AI-powered tool Gamma filled with strategic recommendations and data-driven conclusions

-

Strategic Planning – Evaluated Beats project assets and crafted a focused, results-driven roadmap for successful execution.

Audience Activation – Deployed surveys across key social platforms and synthesized insights into an executive-ready report for C-suite stakeholders.

Connecting ecosystems - Translated survey findings into tangible consumer narratives and transformed them into a dynamic, AI-powered slide deck.

Leveraged the SKIMS brand template to ensure visual consistency and thematic alignment

Letting narratives shine through: Emphasizing an opening for 2 consumer-segments and , identifying strategic ways to build a unified, purpose-driven campaign.

Spotlighted key findings through bold and visually compelling data visualizations designed to resonate with stakeholders.

Building a Launch Timeline – Developed a tailored product rollout, launch style, and channel strategy for two distinct consumer segments. Created a forward-looking roadmap outlining survey validation, product expansion, and market evaluation milestones.

-

Final deliverables included a CEO-ready insights report and a polished slide deck, earning me a certificate in Consumer Behavior and Market Analysis. My research unlocked a key strategic opportunity in the U.S. market for SKIMS to position shapewear toward both lifestyle-conscious and identity-first consumers. The final deck featured a dual-line product launch tailored to each audience segment, a detailed launch timeline, and a full risk-mitigation plan.

The narrative-building process involved multiple creative iterations, collaborating with partners and leveraging AI-powered tools to shape a compelling brand pitch. The process involved blending data analysis, brand strategy, and storytelling to support a rebrand for a global consumer brand. I learned how to segment audiences, translate insights into actionable narratives, and build creative assets that aligned with brand identity.

SKIMS Strategic Campaign Slide deck

Business Question

Should SKIMS expand its marketing to target a more fitness-diverse and body-diverse consumer base? If so, what key features should the products have, what price point should they target, and which consumer segments should be prioritized?

Analysis 1: User Demographics

Demographic Penetration: Narrow but Loyal Audience

Insight: Based on survey data, consistent purchasers are predominantly white female, U.S.-based, and aged 18-24. However, non-purchasers demonstrate openness to SKIMS products

Implication: Current appeal is narrow. To grow, SKIMS should target:

- Gender-diverse and racial-diverse groups through authentic representation

- Older age groups with practical designs and more inclusive sizing

Feature Priorities by Age

Insight: Younger users care most about quality and value, while inclusivity and style are more polarizing.

Implication:: For 18-24s, highlight SKIMS' investment in premium materials and affordability. For others, lead with values-based storytelling.

Analysis 2: Fitness Levels of Respondents

Consumer Fitness Segmentation: Opportunity Beyond the Highly Active

Insight: 75% of respondents report engaging in physical activity at least 1-2 times per week. However, very few wear shapewear daily.

Implication: SKIMS has an opportunity to serve a fitness-conscious audience who may not yet associate shapewear with athletic or wellness activities. Light compression and comfort-focused lines may resonate.

Analysis 3: Shapewear Usage

Product Usage Frequency: Specialty Use Dominates

Insight: Most consumers wear shapewear occasionally, not regularly.

Implication: Marketing should emphasize specific use cases (e.g., events, confidence boost, recovery) rather than everyday wear. Building for both comfort and versatility could extend use.

Analysis 4: Shapewear Features Influencing Purchasing Decisions

Key Purchase Drivers: Function and Value Lead

Insight: Across all respondents, Material Quality and Value for Price are the top-rated features.

Implication: If targeting fitness/body-diverse users, SKIMS should highlight performance-grade materials and fair pricing. Style and inclusivity matter to niche segments but aren't universal priorities.

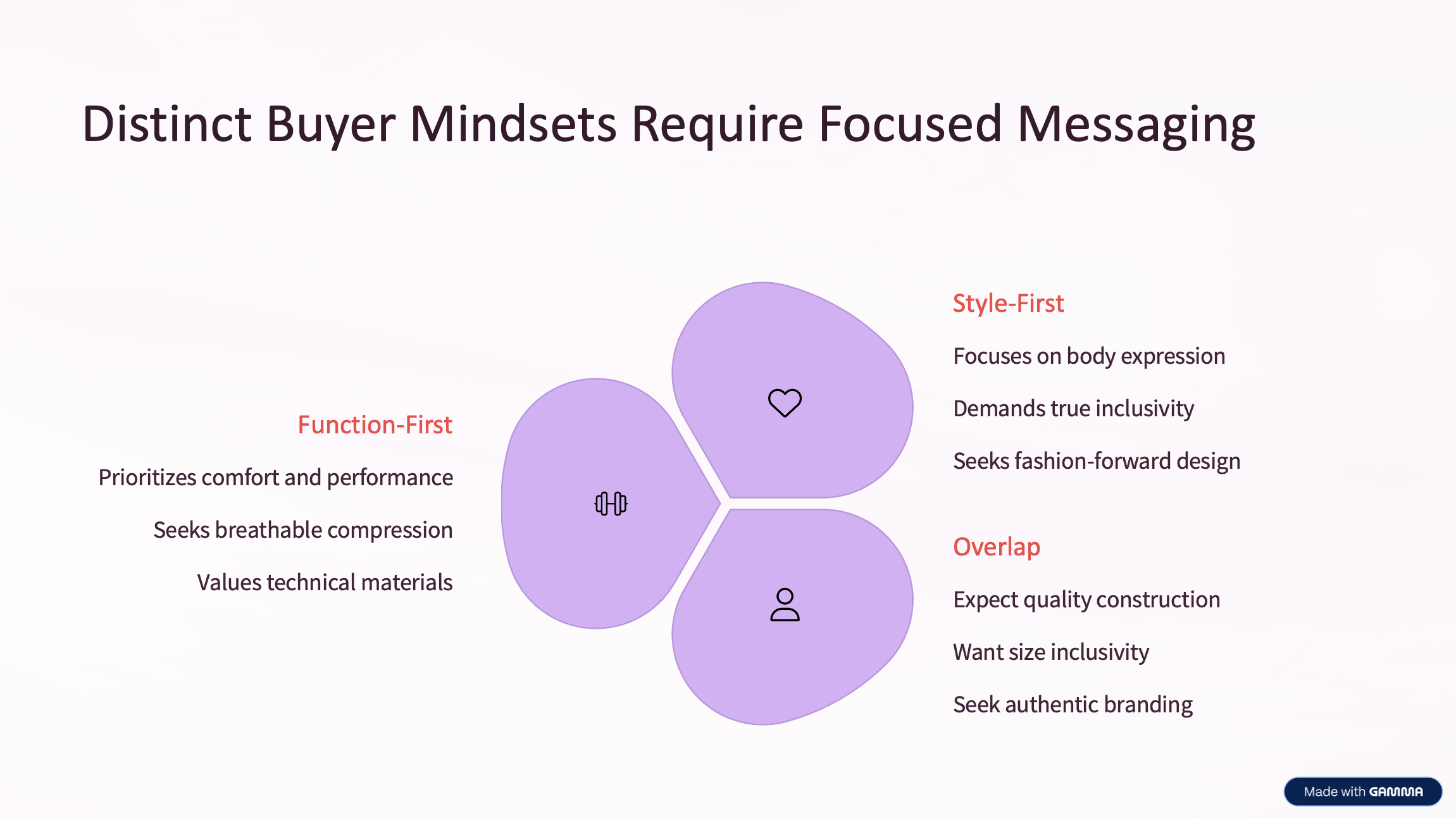

Cluster Segmentation: Two Distinct Buyer Mindsets

Insight: One group values quality and cost; another prioritizes style, inclusivity, and design.

Implication: SKIMS can create dual messaging:

One that emphasizes technical quality and affordability for practical buyers

Another that champions body positivity and fashion for identity-driven buyers

Analysis 5: Occasions for Shapewear

Occasion-Based Usage: Real Use Differs from Perception

Insight: Respondents are more likely to wear shapewear to parties/social events than they believe it's appropriate for.

Implication: This gap suggests untapped emotional positioning; shapewear as a tool for confidence in high-visibility moments.

Recommendation Summary

Yes, SKIMS should expand into the high-need body-diverse consumer-market.

Strategic Targets:

Products: Functional, stylish shapewear with light compression, sweat-wicking fabric, and inclusive sizing.

Price Point: Accessible premium; balance between material quality and fair price.

Segments:

Fitness-conscious but under-engaged users

Gender-diverse and body-diverse consumers seeking inclusivity

Socially-driven younger consumers (18-24) valuing confidence and quality

Next Steps:

Launch a dual-line strategy: Performance Essentials + Identity Collection

Tailor campaign messaging based on cluster preferences

Invest in market research to expand insights beyond the current sample

Prepared for

Emma Grede, CEO of SKIMS

Prepared by

Rhiju Chakraborty, SKIMS Data Analytics Lead

Strategic Insights on Expanding to Fitness-Diverse and Body-Diverse Consumer Segments Business Question

SKIMS CEO REPORT

Emma Grede

Emma Grede is a British businesswoman, serial entrepreneur, and philanthropist. She is the Founding Partner of SKIMS, the Co-Founder & CEO of Good American.